910 Home Loan jobs in India 24 new

Table of Content

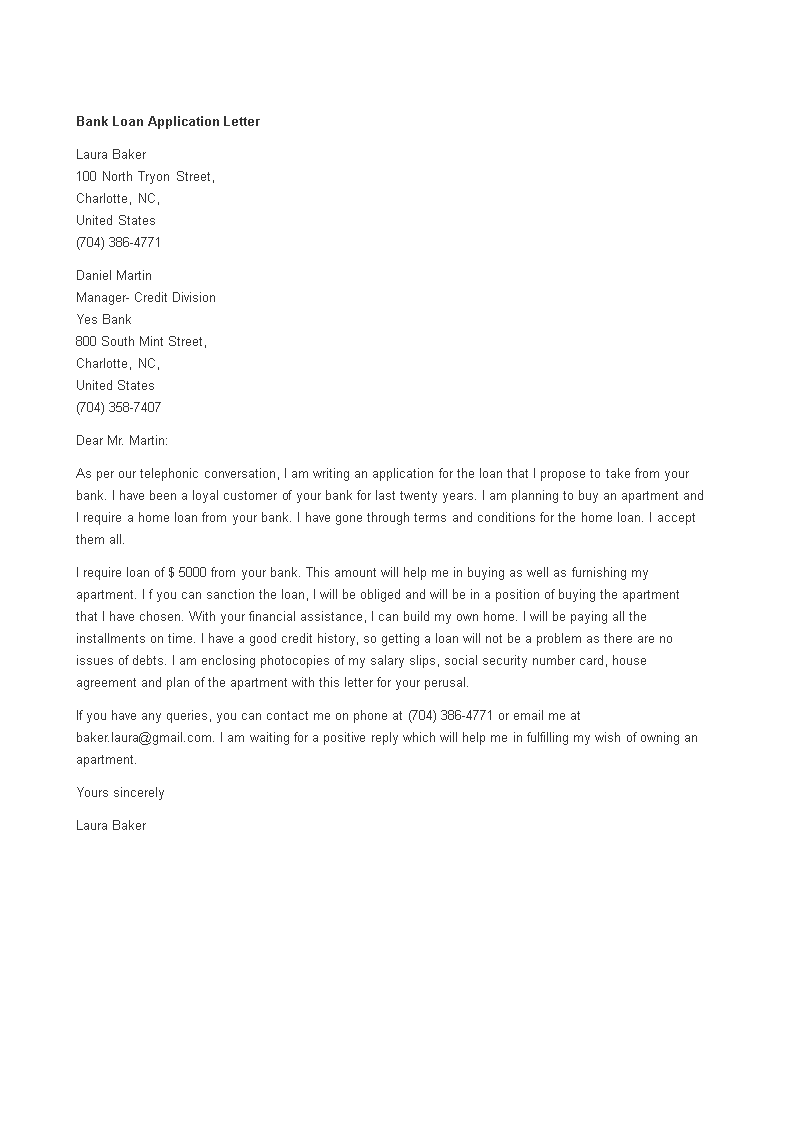

Communicate the reasons for rejection to the customer. Ensure proper closure of disbursement documentation within the timeline. Build new relationships with builder community basis projects and expansion plans. MC is the local Mortgage Specialist who will be the lead for driving the Mortgage business in his / her territory and will have key deliverables of Mortgage volumes and documentation. Save this job with your existing LinkedIn profile, or create a new one. This form requires Javascript be turned on for it to work.

We're one team, committed to growing as a business and as individuals. Some team members within the organization are in remote roles and work outside of a U.S. The mortgage approval is a binding document which certifies that your lender will support you with the funding.

Loan executive

Managing business relations with developers, development authorities, Corporates. Negotiating Skills - Probing to understand customer's need, managing objections, and Structuring solutions, closing. Appraisal - Assessing Market Value of properties offered as security for Loan - Land & Building. It is our endeavor to develop our people continuously by focusing.

Suggesting optimal solutions to customers needs. Documentation -Verification of documents like Building approvals, Plans, Estimates etc, to ensure compliance with applicable building rules and other applicable regulations. HDFC's finest investment is in its Human Resources. It draws its personnel from many disciplines.

Manager Compliance (m/f/d), Frankfurt am Main

The carousel is set to autoplay a different slide every eight seconds. Inactive slides are hidden for all users. Use play/pause button, slide pagination, left/right arrow keys, or swiping to navigate through all slides. All links contained in the carousel are available in website navigation or elsewhere on the page. U.S. Bank is an equal opportunity employer committed to creating a diverse workforce.

We're a culture that puts people first. We celebrate what makes a person unique and help every team member play to their strengths. We're guided by a set of values that help us show up for our customers, our communities and each other. Mortgage lendersto reduce time and optimise the mortgage loan experience. Once you've selected your mortgage offer, we will provide you a document checklist that shows all the required document you need to submit. Like many mortgage brokers, we get paid by the German lender banks.

Trending Skills

Performs in-house and field collateral verification reviews for members borrowing on blanket lien or delivered basis to ensure sufficient levels of marketable collateral exist to secure FHLBank advances and other credit products. Qualifications - Fresh/experienced Graduates/Post Graduates or MBA having good and consistent academic record (Min 60% marks) and good communication skills in English and Malayalam. Qualifications - Fresh/experienced B Com Graduates, M Com, CA or MBA having good and consistent academic record (Min 60% marks) and good communication skills in English and Malayalam. Qualifications - Fresh/experienced B Tech /BE having good and consistent academic record (Min 60% marks) and good communication skills in English and Malayalam. It is the Bank's policy to comply with applicable laws concerning the employment of persons with disabilities, including reasonable accommodation for applicants and employees with disabilities.

Knowledge of financial statement and asset portfolio analysis, residential and commercial loan underwriting methodology, statistical sampling techniques, mortgage banking and secondary market underwriting guidelines. Our reliable, english-speaking mortgage brokers have access to the best German mortgage products and lowest interest rates for international clients purchasing property in Germany. Not only do they provide unbiased guidance in your mortgage decision, they also offer free real estate valuation and mortgage pre-approval service. The Senior Collateral Verification Specialist is tasked with ensuring that the quantity and quality of collateral is sufficient to secure member advances. This position requires a deep understanding of residential and commercial loan underwriting, credit administration, loan documentation standards and FHLBank policies and procedures. In this role, strong verbal and written skills are needed to effectively communicate findings and best serve the membership.

Compliance, Regional Compliance, Vice President - Frankfurt

As a member of our family, you are part of one of the largest independent banks in the U.S. We are proud of our growth and success over the past 100 years and look forward to a bright and promising future. Meet with perspective borrowers to obtain loan applications, explain application process, fees involved, and different programs available, etc. We are proud to offer you convenient, secure, and simple online tools so you can manage your money with ease.

Help our customers realise the dream of home ownership as you analyse home loans with lending authority up to $1.5mil. Bank and are subject to normal credit approval and program guidelines. Deposit products offered by U.S.

24/7 bank by phone system that help make your financial management easier and convenient. Share your contact information with us to get the latest jobs. At U.S. Bank, we support our people so they can grow in the ways that are right for them. We connect them with opportunities to turn big-picture thinking into real-world impact. And we invite every employee to bring their whole selves to work.

The consent herein shall override any registration for DNC/NDNC. Prepares detailed CVR reports and develops member presentation materials that effectively communicate sampling results and findings related to collateral composition, financial performance and overall credit risk. To verify your email address and activate your job alert. Hassle-free, easy-to-use retail banking products to fit your everyday banking needs.

Comments

Post a Comment